Economics Assignment Question & Answer

Would you like to determine our grasp economic theories and concepts? then our economics essay writing service have published their most recent macroeconomics assignment question and answer to an emerging economic phenomena.

You can talk to us to purchase the assignment answer at a small fee.

Macroeconomics Assignment Question

You have been selected as a team member of a new presidential council designed to repair, replenish and grow the economy, as well as, sustain the financial markets. The team is designed to take on overhauling the financial system in its key areas such as The Fed, SEC and other regulatory agencies, bond markets, stock markets, credit markets, and businesses of all sizes while still maintaining a fluid environment. Your report to the president will have to address the problems, conflicts, possible solutions, and ramifications to your possible solutions in great detail. Please provide evidence to support your premises as to which path you will use to help steer the economy.

Macroeconomics Assignment Answer

Formulation of Economic Policy

Economic policy refers to government economic activity. It covers interest rates, budget systems, the labor market, national ownership and many other government economic initiatives. In general, policies aim at four major objectives: stability of the market, encouragement of economic development, sustainability of business and growth and job creation. Sometimes other objectives, such as military spending or nationalization, produce a harmonic economic success environment.

Fiscal policy is the use of public spending and taxation to influence the economy. Governments are using tax policy to achieve the economic objectives of price stability, full employment and economic growth in order to influence aggregate demand in the economy.

The government has two levers in deciding budgetary policy:

- Change composition and tax levels

- Change spending levels in many economic sectors.

There are three main types of fiscal policy:

- The Neutral approach: This kind of policy is usually employed in an equilibrium economy. In this scenario, government expenses are fully funded via fiscal revenues with a balanced effect on macroeconomic activity.

- Expansionary: this kind of strategy is usually implemented in depression to increase economic production. The Gov. spends more money than revenues in this instance.

- Contractionary: The goal of this approach is to reduce public debt and to curb inflation. Public spending is lower in this scenario than tax revenue.

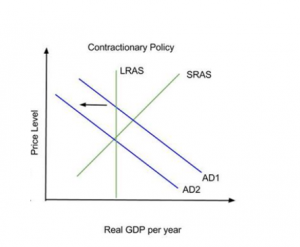

The government may play an active role in altering its expenditure or tax level when it lays down fiscal policy. These activities lead to increased or decreased aggregate demand, which is represented in the right or left shift of the aggregate demand (AD) curve.

Source: The Economics Journal

Economic Policy Approaches

It is worth remembering that aggregate demand for an economy is split into four parts: consumption, investment, public expenditure, and net exports. Changes in any of these components cause the curve of aggregate demand to change.

Expansionary fiscal policy is employed during the recession to kick off the economy. It stimulates aggregate demand, which in turn raises economic production and jobs. In adopting expansionary policies, the government raises expenditure, lowers taxes or combines them. Since government expenditure is a component of aggregate demand, more government spending will move demand to the right curve. A tax decrease would leave more discretionary income and boost consumption and savings and move the aggregate demand curve to the right as well. A rise in government expenditure coupled with a decrease in taxes would predictably push the AD curve to the right. The amount of the AD curve shift due to government expenditure relies on the size of the expenditure multiplier, whereas the shift in the AD curve as a result of tax cutting depends on the size of the tax multiplier. Expansionary policy will lead to a budget deficit if government expenses exceed tax income.

When demand-pull inflation exists, a Contractionary fiscal policy is adopted. It may also be used to repay undesirable debt. The government may reduce its expenditure, increase taxes or seek a mix of the two via Contractionary fiscal policy. The AD curve is shifted towards the left by Contractionary fiscal policies. This kind of strategy, if tax receipts exceed government expenditure, leads to a budget surplus.

This kind of strategy, if tax receipts exceed government expenditure, leads to a budget surplus. Keynesian economics, in times of recession, believe that increasing government expenditure and lowering fiscal rates are the best way to stimulate aggregate demand. Keynesians believe that this approach should be used as the main tool for laying the foundation for strong economic growth and full employment in times of recession or low economic activity. The resulting deficit is supposedly repaid during the following boom by an expanded economy.

Consumers consider inflation forecasts every time they purchase, such a house or a car. The nominal rate for loans to buy these goods fluctuates as inflation varies. The nominal rate is the actual rate plus the inflation component expected. Expected inflation also tells economists how the public views the economic direction. Suppose the population expects inflation to increase. This may be caused by a positive demand shock when the economy develops and aggregate demand increases. It may also result from an adverse supply shock, perhaps from rising energy prices and a decrease in total supplies. Anyway, the public may expect the central bank to adopt a currency policy that reduces inflation and leads to higher interest rates. However, if experts foresee inflation to decrease, the public may anticipate a recession. The public may expect short-term monetary expansion and reduced interest rates. Economists are informed about the effectiveness of macroeconomic policy by monitoring expected inflation. Furthermore, tracking expected inflation allows for real interest rates to be projected that isolate inflation impacts. This information is important for investment financing decision-making.

Although inflation expectations may seem to be a highly speculative idea, the activities of the Fed are based on early research by Joseph Livingston, financial journalist for Philadelphia Inquirer. In 1946, economists started a two-year survey of their inflation forecasts. The survey was carried out by the Federal Reserve Bank and other economic research institutions, such as the Survey Research Center of the University of Michigan, the United States Statistical Association and the National Bureau for Economic Research, following the death of Livingston in 1969.

These assumptions are similar to present Federal Reserve inflation and the results to date are different. In recent decades, however, the forecasts of economists have become considerably more precise. Economists are continually investigating the form and evolution of inflation and other economic variables.

Economic Stimulus Program Recommendations In COVID-19 Times

Despite the enormous human costs of recessions, we must assess the policy tools at our disposal and choose those that are most effective in speeding economic recovery during a downturn. In this article, we describe how the economic crisis in Covid-19 has affected various worker groups, what work is being done with fiscal stimulus, what could be done differently in future recessions, and how the states are positioned to thrive economically.

Monetary and fiscal policy are the two sets of policy tools used to support recovery following recessions. During and after a recession, the Federal Reserve’s monetary policy is used to keep interest rates low and reduce unemployment. The fiscal policy refers to the many types of government spending and tax reductions that Congress has enacted. Following the recession, both sets of policy tools may be used to increase demand, expand output, and quickly return the economy to pre-crisis conditions.

In order to be most efficient, a speedy stimulation is essential. A part of the fiscal policy reaction took place automatically under existing programs in the Covid-19 economic slump. These programs are referred regarded as “automatic stabilizers,” since they offer instant stimulus during a recession without Congressional intervention. This is why automatic stabilizers such as supplementary nutritional assistance, unemployment insurance and Medicaid, as well as automatic tax revenue stabilization, are so useful.

It is generally accepted that fiscal stimulus under HEROES lessened the severity of the Covid-19 economic slump. The CBO estimates that the fiscal stimulus package in 2021 resulted in GDP being 0.5 to 3% higher than it would otherwise have been (CBO 2021). But which fiscal stimulus components were most useful? Incentives aiming at families with low incomes or otherwise restricted funds tend to be more successful, while corporate tax cuts tend to be less effective (Whalen and Reichling 2015). In some estimates, government expenditure is usually more successful than tax cuts, partly because employees only spend a fraction of the stimulus given by the tax regime. Across all stimulus types, fiscal stimulus is generally assumed to be more effective in recessions and less effective in expansion (Morley and Panovska, 2014) due to slackness in labor and capital markets (i.e. the available resources are not fully utilized), which enables fiscal stimulus to increase total production.

Regardless of all money related and financial measures made to lessen the seriousness of the monetary droop at Coronavirus, creation has not yet recuperated to either its pre-downturn pattern or imminent yield (CBO 2021b). Joblessness has quite recently gotten back to a pre-downturn level, while other leeway work market pointers, for example, the level of representatives working low maintenance for financial purposes stay high (Department of Work Insights [BLS] 2021a). In addition, states are not prepared as expected for the following downturn. Blustery day holds in many nations keep on being deficient to manage a critical and startling drop in charge pay. These legislatures should either decrease fundamental taxpayer driven organizations—which hurt both state individuals and the more extensive economy—or rely upon the government for monetary help.

Moreover, despite the fact that joblessness and destitution are on the ascent, two key projects – transitory help for families out of luck and the joblessness protection – have responded in an unexpected way. UI guarantee went up because of the developing number of recently jobless representatives buffering qualified specialists from misfortunes. Not all recently jobless individuals were equipped for UI, yet the program was by and large compelling in its objective. Conversely, TANF’s caseload rose little as destitution expanded. In spite of the fact that TANF has a job in soothing extreme destitution, it’s anything but yet intended to respond proficiently to or fill in as a programmed stabilizer against recurrent neediness changes.

A key reason of the monetary procedure of the Hamilton Undertaking is that drawn out success is best accomplished through empowering financial turn of events and wide contribution in development. The Hamilton project gives the accompanying nine realities about the Coronavirus financial emergency and the kinds of monetary upgrade to decrease the seriousness of future downturns.

Utilization of financial policing powers

Strategy creators rely upon two arrangements of instruments to advance recuperation after a downturn. The Central bank’s financial approach is used to keep up with low loan costs and decline joblessness during and after a downturn. The financial approach covers a few sorts of government use and assessment decrease carried out by Congress. After the downturn, both arrangement sets might be utilized to support interest and consequently increment creation and make the economy more pre-recessionary.

The two duties available to the public authority for deciding monetary approach are use and assessments. The public authority is expanding its expansionary financial arrangement, reducing government expenditures or a blend of both. The ascent in consumption and assessment decreases will prompt an increment in all out interest, albeit the expansion depends on spending and expense multipliers.

Expansionary strategy avocation

The multiplier in government use is one that shows the adjustment of total interest as a result of a specific change in use. The multiplier effect of government spending is clear when an increment in use prompts an expansion in pay and utilization. The expense multiplier is the expansion effect of an adjustment of total interest charges. The decrease in charges is practically identical to the ascent in government use for money and utilization.

Expansionary monetary arrangement may have a monetary multiplier impact on the Gross domestic product. The financial multiplier is the proportion of the adjustment of public income to the adjustment of government use that produces it. This multiplier is unconfutable with the financial multiplier. The expanded effect on public pay is named the multiplier impact when this multiplier outperforms one.

The multiplier impact happens when an underlying expansion in government spending prompts higher wages and utilization, an increment in pay and, accordingly, to more purchaser spending, and so forth, prompting a generally speaking higher pay than the first extra consumption. As such, an underlying change in the total interest may prompt a numerous adjustment of total creation (and hence the total pay that it produces). The multiplier impact has been utilized to help the viability of government consumption or duty alleviation to support total interest.

Assume, for instance, that the public authority contributes 100,000 dollars to build a manufacturing plant. The cash isn’t lost yet rather becomes pay rates for the developers, pay for the providers, and so on The developers will have more optional cash, and spending will expand, which will likewise build total interest. Assume likewise that the recipients of the developers’ expanded costs thus spend their new income, increment interest and maybe utilization, etc. The development in the total national output is the all out of the net gain increments for everybody concerned. In the event that the developer gets 100,000 dollars and pays 80,000 dollars to subcontractors he has an overall gain of 20,000 dollars and a proportionate expansion in extra cash.

To support the economy during the downturn, governments may utilize monetary strategies – expanded government spending or tax breaks. A gauge of the upgraded creation prompted by a specific expansion in government consumption or duty decline is the monetary multiplier. Any multiplier more than zero implies that greater government use builds in general creation. More than one financial multiplier shows an ascent in private area creation combined with an increment in government yield.

There are conflicts among financial specialists on the exact size of the distinctive monetary multipliers, as indicated by Auerbach, Storm and Harris (2010), which is generally thought to be more prominent during downturns than under ordinary monetary conditions when the economy nearly has its maximum capacity Fazzari, Morley and Panovska(2014); additionally the contradicting position of Ramey and Zubairy(2014). This is likely on the grounds that slumps in both work and capital business sectors are set apart by a slackness (for example the accessible assets are not utilized in full), which empowers financial motivators to help generally creation. Multipliers are likewise more noteworthy when lower-pay people are bound to utilize the boost in the use or tax breaks (Parker et al. 2013; Whalen and Reichling 2015).

Reasoning for Duty decrease

Tax reductions may likewise offer supportive improvement, yet multiplier gauges for the most part are more modest and more unpredictable than use programs projections. The assessments shift from 1.8 to 0.33 in 2021 for the sped up deterioration of the kids’ tax reduction, which empowers organizations effectively to delay charge commitments.

While a few tax reductions had more than one monetary multiplier during the emergency, just the Youngster Tax break multipliers and the refundable single amount financial discount in 2021 were as yet higher than one. Also, their qualities were lower than for consumption multipliers, for example, raising SNAP instalments and expanding UI benefits. Spending projects or tax breaks expected to people with lower pay will in general have bigger multipliers, since they are more disposed than people with higher pay to spend what they get. In addition, measures like sped up devaluation and decrease in corporate assessment rates, both profiting organizations, are less invigorating than singular tax reductions.

The expense multiplier is by the by lower than the use multiplier. This is on the grounds that when the public authority goes through cash it purchases things straightforwardly, which brings about the whole change in spending being applied to total interest. At the point when the public authority brings down charges all things considered, the extra cash increments. Segment of the discretionary cash flow is spent, however part is kept. The set aside cash doesn’t add to the multiplier impact.

Maintain an effective federal funds rate

The Federal Reserve has two main functions as the central financial institution of the United States, commonly called its dual mandate:

- Preserve price stability and

- Assist the economy stay close to the highest possible level of sustainable employment.

Over the most recent 50 years, as the economy has gone through every downturn, joblessness has risen a normal of 2.5 rate focuses. The central bank reacts to these work market changes by utilizing open-market tasks, including the procurement and offer of protections, bringing down the government store rate (the loan fee at which organizations loan stores to different foundations short-term on the Federal Reserve) and as of late growing its asset report. At the point when monetary conditions fall apart, government store decreases diminish financial loan fees, urge endeavours to extend and enlist more individuals, and urge buyers to spend more, accordingly lessening the joblessness rate.

Employment stimulation

The financial emergency in Covid-19 has essentially diminished the quantity of representatives in the United States, yet these cuts have been concentrated among guys, more youthful individuals, and lesser instructed laborers. This might be an outcome of a purported business stepping stool that sensibiliser’s low gifted workers and youngsters to the monetary cycle excessively (Beaudry, Green, and Sand 2013). Figure 2a shows that from December 2019 to December 2021 the utilized extent of the populace matured 25 and more seasoned by instructive level and sex changes, demonstrating a work market drop. Business dropped all the more steeply for low-level workers, in spite of the fact that ladies with not exactly a secondary school degree just saw a 3.4 percent work misfortune. In all instruction and age classifications, guys would in general endure more prominent abatements than ladies. The work share for guys without a secondary school degree diminished most; note that men will in general endure additional during downturns, principally on the grounds that they will in general be occupied with more repeating areas (Hoynes, Miller, and Schaller 2012).

In conclusion, adopting an expansionary fiscal policy in line with modern Keynesian principles would raise the GDP with a relatively higher multiplier. Regulated Government spending in long term infrastructure would stimulate the current economic drain as well as position the country for future economic success. Achieving short-term economic recovery and long term sustainability is a multiple of both tax and government spending policies. The government should provide support as well as offer affordable and appropriate tax cuts to facilitate gross investment. Affordable FED rate should also be set out to facilitate loan capital to create the supply push needed to multiply the economic growth.

References

CBO. (2021). Congressional Budget office. Retrieved from Congressional Budget office: https://www.cbo.gov/data/budget-economic-data

Roberto, C., &Ayhan, K. II Economic Impact of US Budget Policies. In US Fiscal Policies and Priorities for Long-Run Sustainability. International Monetary Fund.

Beaudry P., Green,D., and Sand B. (2013). The Great Reversal in the Demand for Skill and Cognitive Tasks.

Hoynes, H., Miller, D. L., & Schaller, J. (2012). Who suffers during recessions?. Journal of Economic perspectives, 26(3), 27-48.Whalen, C. J., &Reichling, F. (2015). The fiscal multiplier and economic policy analysis in the United States. Contemporary Economic Policy, 33(4), 735-746.

Parker, Jonathan A., Nicholas S. Souleles, David S. Johnson, and Robert McClelland. “Consumer spending and the economic stimulus payments of 2008.” American Economic Review 103, no. 6 (2013): 2530-53.

Fazzari, S. M., Morley, J., &Panovska, I. (2015). State-dependent effects of fiscal policy. Studies in Nonlinear Dynamics & Econometrics, 19(3), 285-315.

Zubairy, S. (2014). On fiscal multipliers: Estimates from a medium scale DSGE model. International Economic Review, 55(1), 169-195.

Fazzari, S. M., Morley, J., &Panovska, I. (2020). When is discretionary fiscal policy effective?. Studies in Nonlinear Dynamics & Econometrics.

If you found the economics assignment question and answer helpful. Don’t hesitate to talk to expert writing help for assistance in economics essays, research papers and term papers.